February 23, 2018

Amid concerns about renewed political stalemate in Springfield, Illinois Governor Bruce Rauner on February 14, 2018 proposed a budget for the next fiscal year that relies on shifting State pension and health insurance costs to school districts and public employees.

The budget recommendation for fiscal year 2019 also requires public universities and community colleges to pick up additional pension and healthcare costs. However, many of those costs would be offset by increased funding—at least for FY2019, which begins on July 1, 2018.

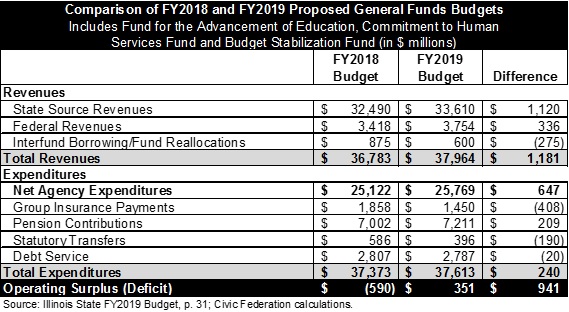

With general operating fund revenues of $38.0 billion and expenditures of $37.6 billion, the proposed budget has a modest operating surplus of $351 million. But the financial plan depends on statutory changes that might be resisted by the General Assembly and revenues that might not be realized if the long proposed sale of the James R. Thompson Center in Chicago does not occur.

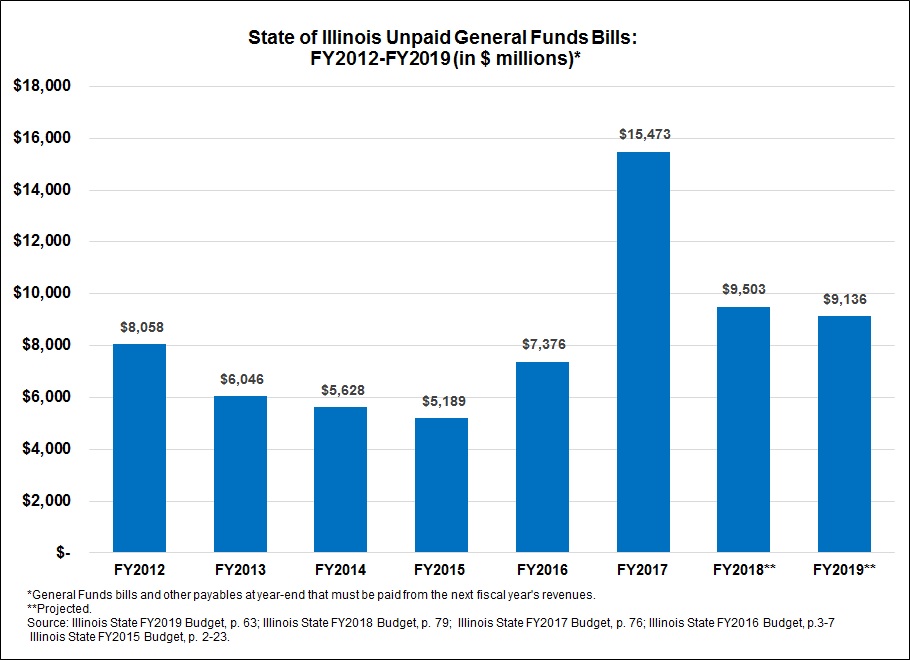

The Governor’s FY2019 budget does little to address the State’s huge backlog of bills. The backlog is expected to stand at $9.1 billion at the end of the year on a budgetary basis, compared with $9.5 billion at the end of FY2018.[1] That means the State would need to use nearly one-quarter of projected FY2020 revenues to pay off accumulated bills at the end of FY2019. The FY2018 backlog amount includes $1.1 billion of supplemental appropriations proposed as part of the FY2018 budget to cover under-appropriated liabilities from FY2017.

Despite the massive backlog, the FY2019 budget involved fewer challenges than the other three financial plans presented by Governor Rauner. The Governor took office in January 2015, the same month that income tax rates were automatically reduced under a 2011 law, creating a significant budget gap. As discussed here, the Republican Governor and the General Assembly, which is controlled by Democrats, were unable to enact complete budgets for FY2016 or FY2017.

The two-year budget impasse ended in July 2017, when the legislature enacted a budget for FY2018 over the veto of Governor Rauner. Individual income tax rates, which had been raised to 5.0% from 3.0% in 2011 and lowered to 3.75% in 2015, were permanently increased to 4.95%. Corporate income tax rates, which went to 7.0% from 4.8% in 2011 and fell to 5.25% in 2015, were permanently returned to 7.0%.[2] Largely as a result of the rate increases, total income tax revenues are expected to rise by $4.5 billion, or 30.0%, in FY2018 to $19.5 billion from $15.0 billion in FY2017.[3]

The Governor’s FY2019 budget proposes rolling back the individual income tax rate by one-quarter of a percentage point to 4.7%, which would reduce revenues by an estimated $917 million.[4] However, the change would take effect only if the General Assembly approves offsetting pension savings of about $900 million. The savings would come from a pension plan along the lines of the consideration model proposed by Illinois Senate President John Cullerton, which requires workers entitled to the State’s most generous tier of pensions to choose between two options with less costly benefits.

It remains to be seen whether the consideration approach would be upheld by the Illinois Supreme Court. In May 2015, the high court rejected a law passed in December 2013 that cut pension benefits for both employees and retirees, ruling that it violated the Illinois Constitution’s stringent pension protection clause. Even if the Governor Rauner’s pension proposal is approved by the legislature, officials in the Governor’s Office of Management and Budget said savings would not be reflected in the budget until all legal challenges are resolved.

FY2019 Revenues

The revenue forecast in the proposed FY2019 budget is higher than in previous years, mainly due to the permanent income tax increase enacted in FY2018. State revenues are also aided by the proposal to continue to reduce by 10% the amount of income and sales taxes deposited into the Local Government Distributive Fund and two public transportation funds, a practice that began in FY2018.[5]

The State’s economic performance may contribute to increased revenues as well. The Governor’s Office revised its personal income tax estimates for both FY2018 and FY2019 upward from the five-year forecast released in October 2017, by $360 million and $679 million respectively. These revisions are based on expected economic growth due to federal tax cuts and on higher-than-forecast year-to-date income tax receipts. The Governor’s Office believes that only part of the over-performance can be attributed to prepayment of taxes in order to take advantage of the expiring federal deduction for state and local taxes. The result of the forecast revisions is a $543 million increase in personal income tax in FY2019 over FY2018. Total FY2019 State-source revenues are expected to be $1.2 billion higher than the prior year.

The proposed FY2019 budget, like the FY2017 and FY2018 proposed budgets before it, relies on the sale of the Thompson Center. The Governor’s Office has removed the planned $300 million in gross revenues from its estimate of FY2018 actual revenues and now has incorporated them into the forecast for FY2019. Net of expenses, the sale is projected to produce $240 million. As was the case last year, it is not clear whether the State will succeed in selling the property at the projected price by the end of FY2019.

Legislation authorizing the sale passed both chambers of the Illinois General Assembly last May, but has been held from proceeding to the Governor for signature. In June, the Governor and Chicago Mayor Rahm Emanuel blamed each other for holding up the deal over issues related to zoning and the expense for accommodations to the Chicago Transit Authority’s Clark/Lake Station.

The other major change to revenues is the addition of $875 million in revenue to the FY2018 estimate and $600 million to FY2019 from interfund borrowing and fund sweeps. These transactions were authorized by the General Assembly as part of the FY2018 budget, but were restricted to paying down the bill backlog and specified a two-year repayment period for the borrowing.[6] The Governor now proposes to eliminate this restriction and the requirement to pay back the other funds,[7] which would reclassify $275 million in fund sweeps and $600 million in interfund borrowing as revenue in FY2018.[8] Because the $1.2 billion in borrowing authority extended through December 2018, the Governor proposes to use the remaining $600 million (without repayment) as General Funds revenue in FY2019.

FY2019 Expenditures

The Governor’s budget includes General Funds spending of $37.6 billion, an increase of $240 million, or less than 1.0%, from $37.4 billion in FY2018. The FY2018 expenditure figure does not include the proposed supplemental appropriations of $1.1 billion, mainly to pay for Medicaid costs and day-to-day operational expenses of agencies such as the Department of Corrections that were not funded in FY2017.

Pensions

Proposed General Funds contributions to the State’s five pension funds are $7.2 billion in FY2019, a decrease of $363 million from the previously projected amount of about $7.6 billion. As discussed here, the Governor recommends shifting 25% of current-year pension costs (also known as normal costs) each year for the next four years from the State to school districts outside Chicago, public universities and community colleges.

The State currently pays both the normal and unfunded liability costs for members of the Teachers’ Retirement System (TRS) and State Universities Retirement System (SURS). In contrast, Chicago Public Schools (CPS) covered all pension costs for its teachers until FY2018, when education funding legislation enacted in August 2017 required the State to start paying for normal costs of Chicago teachers’ pensions.

The FY2019 budget proposal returns responsibility for the normal costs of the Chicago Teachers’ Pension Fund to CPS. All of the costs would be shifted back in FY2019, saving the State $228 million.

Group Health Insurance

As in the Rauner administration’s previous budget proposals, the FY2019 budget recommends significantly lowering State employee group health insurance costs by requiring workers to choose between increased premiums or reduced coverage. The FY2019 savings are estimated at $470 million over maintenance levels.

The proposal was a major sticking point in negotiations between the State and its largest union, the American Federation of State, County and Municipal Employees (AFSCME) over a new contract to replace the agreement that expired at the end of FY2015. The union is challenging the administration’s effort to implement its final offer in a lawsuit pending in the Illinois Fourth District Court of Appeals. The Governor plans to propose legislation to remove employee health insurance from collective bargaining.[9]

In addition to State workers and retirees, the State group health insurance program covers public university employees and retirees. The FY2019 budget recommends increasing the share of employee health insurance costs paid by universities by $105 million, to $150 million from $45 million.

Retirees with at least 20 years of service who are covered by the State group insurance program do not pay any premiums. A law to eliminate premium-free health insurance was struck down by the Illinois Supreme Court in 2014. However, retired public school teachers and community college employees outside of Chicago are covered by separate insurance programs that require participants to pay significant premiums.

The proposed FY2019 budget would eliminate State funding for the Teachers’ Retirement Insurance Program (TRIP) and the College Insurance Program (CIP), for a savings of $129 million. The State provides about 24% of annual revenues for TRIP and 15% for CIP, both of which are not financially viable in the long run, even with the current State contributions.

Education

General Funds appropriations for elementary and secondary education increase by $330 million in FY2019 to $8.3 billion. An increase of $350 million for the new education funding formula—the annual target increase in the legislation enacted in August 2017—is offset by other reductions.

Higher education appropriations increase by $226 million to just under $2.0 billion in FY2019. About $206 million of the increase is additional funding to offset the pension and health insurance costs shifted to universities and community colleges, as discussed above. Without that additional funding, the proposed FY2019 higher education appropriation is almost 10% below the FY2015 level.

Healthcare and Human Services

The FY2019 budget assumes $150 million in savings from a proposed 4% reduction in reimbursement rates for most Medicaid providers, which would take effect in the second half of the fiscal year. An additional $25 million in savings would come from a reversal of rate increases included in the FY2018 budget. Despite these reductions, the General Funds budget for the Department of Healthcare and Family Services, the State’s main Medicaid agency, would increase by $756 million to $7.9 billion in FY2019 from $7.1 billion in FY2018. The FY2018 amount does not include $443 million in proposed supplemental appropriations.

Funding for human services agencies declines by $292 million to $5.8 billion in the proposed FY2019 budget from $6.1 billion in FY2018. Administration officials have said that proposed spending reductions for programs including childcare subsidies for low income parents reflect decreased enrollment.

The following table compares the Governor’s FY2019 budget plan with the enacted FY2018 budget. Spending for FY2018 does not include proposed supplemental appropriations. In the FY2019 budget, net agency expenditures reflect both reduced State payments for CPS pensions and increased funding for universities and community colleges to offset lower State pension and health insurance contributions.

Unpaid Bill Backlog

After two years with no comprehensive budget, Illinois ended FY2017 with a nearly $15.5 billion backlog of unpaid bills, nearly double its previous year-end peak in FY2012. These figures are measured on a budgetary basis and reflect the total bills and payables at year end that must be paid from a subsequent year’s revenues. The Office of the Comptroller uses a point-in-time measure of outstanding bills that varies on a daily basis. According to that measure, the backlog stood at $14.7 billion at the end of FY2017 and peaked at nearly $16.7 billion in November 2017.

Despite the projected operating deficit of $590 million in FY2018 and the proposed $1.1 billion in supplemental appropriations, the backlog is expected to have fallen to $9.5 billion by the end of FY2018.[10] The primary cause of the reduction is the $6.0 billion of bonds issued by the State in November 2017. The State generated additional backlog reduction by paying Medicaid bills, resulting in federal reimbursements that could further reduce the backlog. Repayment of the bonds will last twelve years and cost the State over $1.9 billion at an interest rate of 3.5%, although this is substantially lower than the 9% to 12% interest the State pays on overdue bills.

The following chart shows the history of the bill backlog on a budgetary basis since FY2012 and projections through the end of FY2019. The Governor’s Office projects an operating surplus of $351 million in FY2019 that will be used to further reduce the backlog to just above $9.1 billion. However, the proposed budget contains no plan for any further reduction.

[1] Illinois State FY2019 Budget, p. 63.

[2] Corporations also pay a Personal Property Replacement Tax of 2.5%.

[3] Illinois State FY2019 Budget, p. 31.

[4] Illinois State FY2019 Budget, p. 31.

[5] Illinois State FY2019 Budget, p. 60.

[6] Illinois State FY2019 Budget, p. 58.

[7] Illinois State FY2019 Budget, p. 60.

[8] Illinois State FY2019 Budget, p. 153.

[9] Illinois State FY2019 Budget, p. 48.

[10] Illinois State FY2019 Budget, p. 63.